rivian federal tax credit

This will most likely limit the Rivian Trims to the. New proposed federal EV tax credit for trucks vans and SUVs capped at 80000.

Toyota S Federal Ev Tax Credits Are All Dried Up

August 15 2022 0140 PM.

. So if you were about to buy a Rivian the takeaway is that theres a good chance your tax credit is about to disappear. While the act places more. General Motors Co.

Joined Dec 22 2020. First the vehicle had to be acquired after December 31 2009. Dual Motor Large Battery Pack.

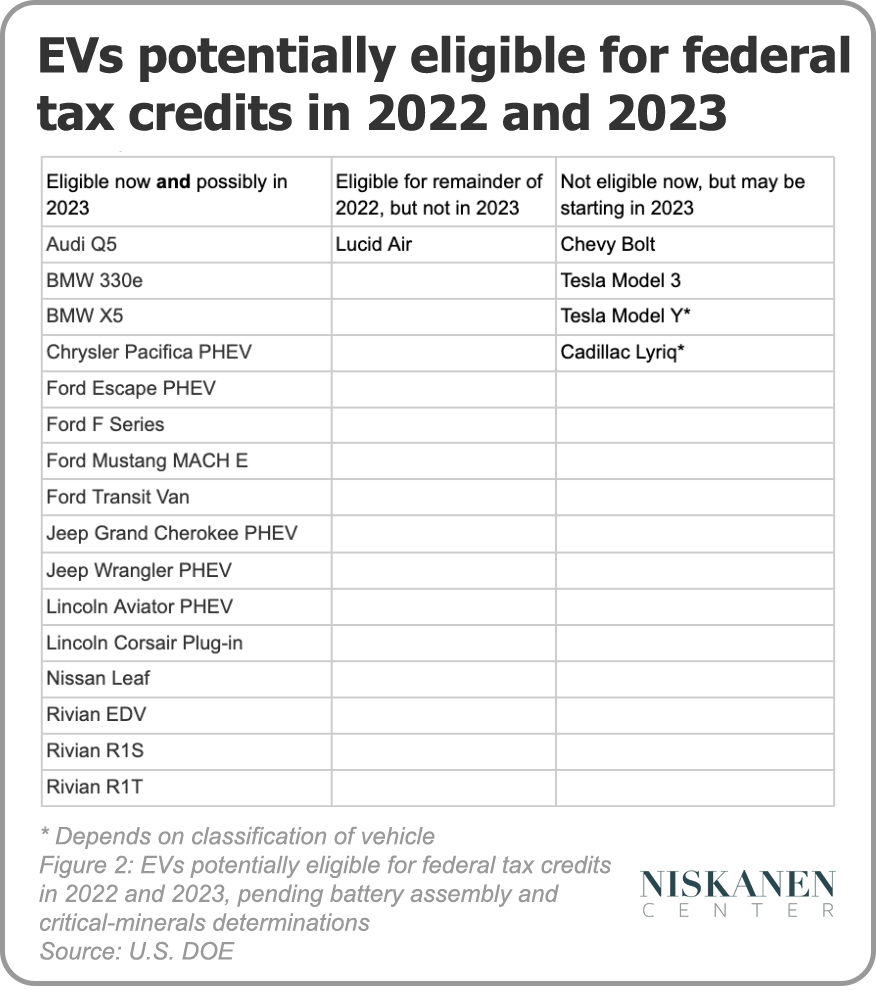

Luxury electric vehicle startups Rivian Automotive and Lucid Motors rushed to help reservation holders qualify for the current 7500 federal tax credit before the. This requirements allowsblocks half the credit. Rivian may be getting lots of tax incentives from state and local leaders in Georgia to build a massive new.

At this time were no longer accepting new binding order agreements to purchase Rivian vehicles. So if Rivians critical minerals is below 40 next year 3750 of the credit goes away. The new Inflation Reduction Act is about to be signed into law by President Biden and among many new rules meant to encourage electric car adoption some rules will.

If you are taking delivery in 2022 you are eligible for the previous 7500 federal credit. I believe the 750000 tax credit applies to a Rivian purchased this year. Will be able to meet all requirements in three years for buyers of its electric vehicles to get the full 7500 federal tax credit Chief Executive Officer Mary Barra.

SoCal_GlacierR1T 3 hr. Federal Incentives The United States Federal government provides a 30 tax credit of the total cost of purchasing and installing an electric vehicle charging station. How much you can claim on your income tax depends on several factors.

The system must be placed in. Luxury electric vehicle startups Rivian Automotive and Lucid Motors are rushing to help reservation holders qualify for the current. Rivian R1S and R1T.

Fords never lost their eligibility for a federal tax credit unlike GM vehicles that wont get it back until 112023 so if you need an electric pickup right now. The federal solar investment tax credit ITC is a tax credit that can be claimed on federal income taxes for 30 of the cost of a solar photovoltaic PV system. Consumers considering the purchase of a 2022 Rivian R1S or.

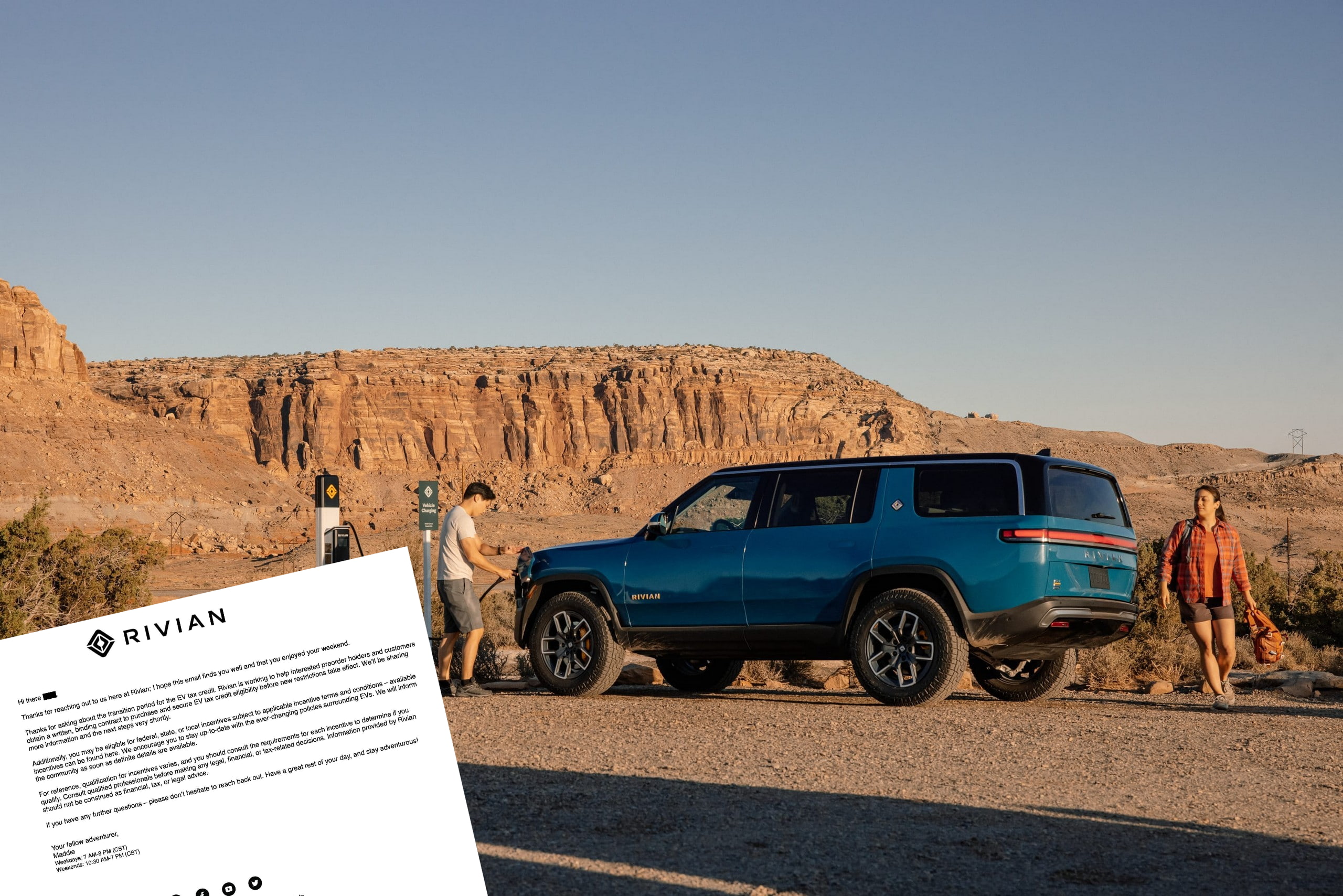

EV batterys components must be manufactured or. 2nd 2022 910 am PT. Rivian posted a page on its website explaining how the Inflation Reduction Act may affect buyer access to the 7500 federal electric vehicle EV credit.

If the vehicle qualifies you can receive. If the tax credit is not available for the Rivian I will need to look elsewhere for a forever car in the 70k range. The federal government is offering a tax credit of up to 7500 for new all-electric and plug-in hybrid vehicles.

The preference would be a BEV but as noted I need extra range. Rivian RIVN commented on the new EV federal tax that is expected to be adopted and the American. Rivian Fisker and other EV makers are offering binding purchase agreements to reservation holders after the Senate passed the Inflation Reduction Act with big EV tax credit changes.

Quad Motor with Large battery pack at 795K with price increase or. Regardless of whether you signed Rivians purchase agreement. Rivians Tax Credit Dilemma.

On Tuesday August 16 the Inflation Reduction Act was signed into law. 3 Jan 21 2021. Theoretically Rivians R1T and R1S EVs look like most models would qualify for the new Clean Vehicle Credit.

United States You may be eligible for federal state or local incentives subject to applicable incentive terms and conditions Federal Incentives The United States offers an electric vehicle. If he were to increase the tax credits I imagine it would. Base prices fall below the 80000.

But Rivian has a solution according to the press release. Electric truck maker Rivian is none too happy about the passage of the new Inflation Reduction Act which puts an 80000 cap on the price of vehicles eligible for the full 7500.

How The New Ev Tax Credit Bill Could Impact Fisker Fiskerati

The 2022 Rivian R1t Is Everything You Hoped It Would Be

Georgia Judge Nixes Tax Break For Electric Truck Firm Rivian

Does The Rivian R1s Suv Qualify For The Federal Ev Tax Credit

Rivian Got Disqualified From New Ev Tax Credits Youtube

How Will The Inflation Reduction Act Impact My Eligibility For The Electric Vehicle Ev Federal Tax Credit Support Center Rivian

Rivian Announces Additional Delay Showcases Off Road Sand Mode Futurecar Com Via Futurecar Media

What Vehicle Incentives Do I Qualify For Support Center Rivian

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax Credit News Cars Com

Rivian Drops Most Affordable Explore Package For R1t R1s News Cars Com

Updated Federal Tax Credit Revamp Sets Msrp Cap At 80k R Rivian

Electric Cars Surging Prices Mean Fewer Buyers Can Use Tax Credit Crain S Chicago Business

Rivian S Return Policy Way More Generous Than Tesla S Carbuzz

Charged Evs The Redesigned Federal Ev Tax Credit And Other Ev Related Measures Charged Evs

Federal Ev Tax Credits Are About To Become Scarce Who Should Get Them Niskanen Center

Rivian To Offer Binding Purchase Agreements To Help Obtain Ev Tax Credit Rivian Forums R1t R1s Owners News Discussions Rivn Stock

Industry Group Says Most Evs Will No Longer Qualify For Federal Tax Credits Abc News

Rivian S Going To Give Pre Order Holders The Buyer S Agreement They Ll Get The 7 500